Payments

This chapter contains:

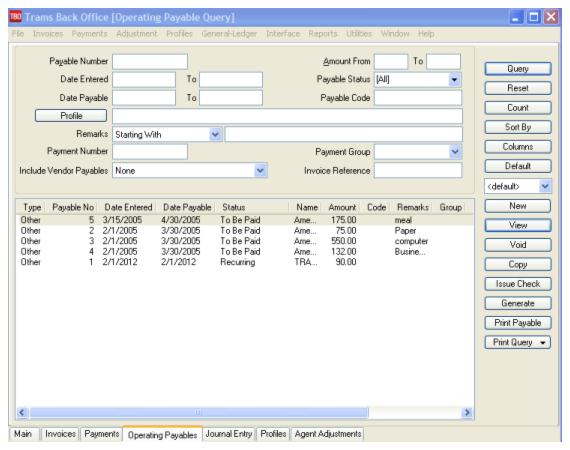

- Overview of Payment Query feature

- Overview Receipts and Payments

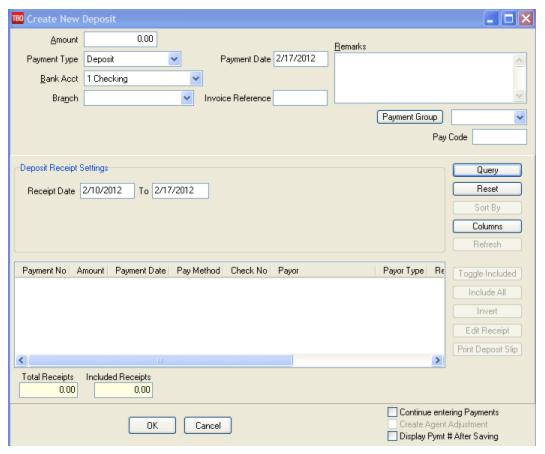

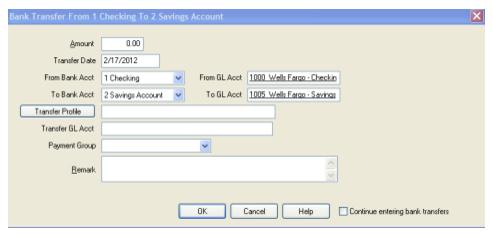

- How to make Bank Deposits, Withdrawals, Transfers

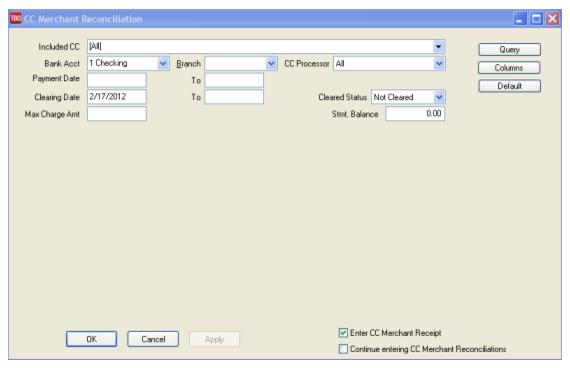

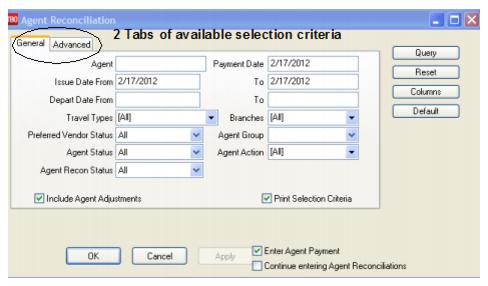

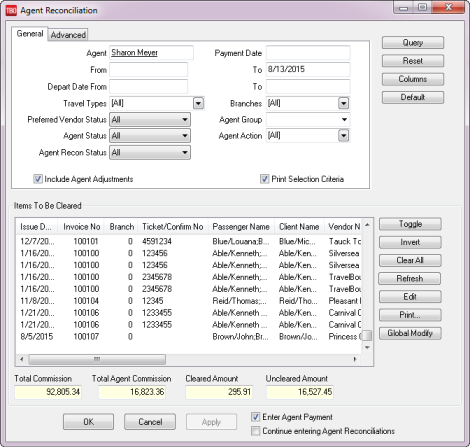

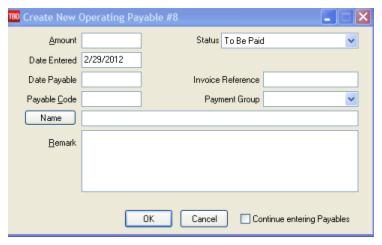

- How to do a Bank Reconciliation, CC Merchant Reconciliation and Agent Reconciliation

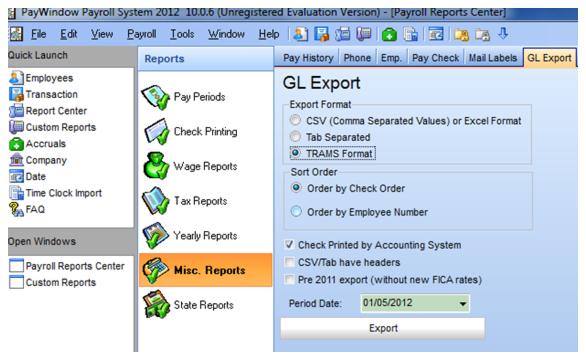

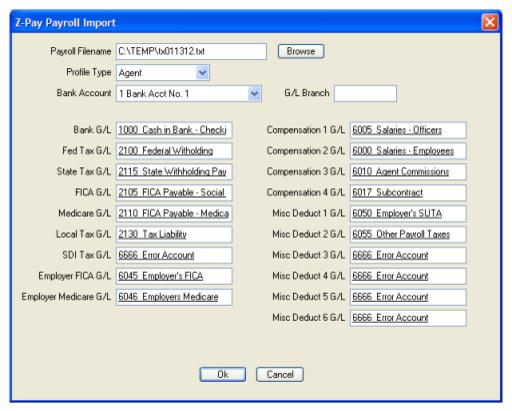

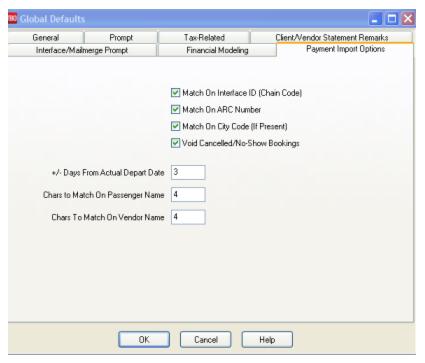

- Overview of Payable Functions, ARC/BSP Settlement, Payroll Import, and Import

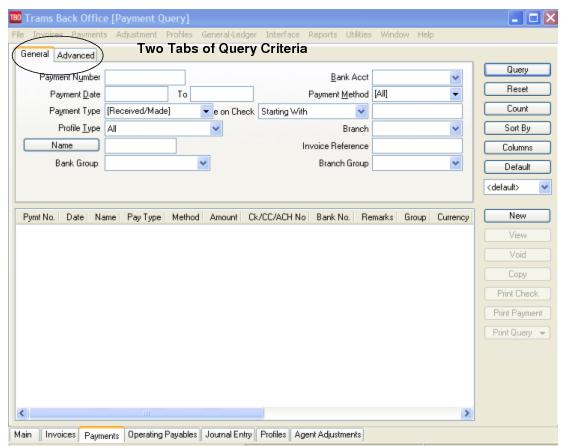

Payments Received or Made

These are the payments received from or made to Clients (Leisure or Corporate), Vendors (Supplier, or Commission Tracking), ARC (ARC/BSP Settlement), Agent, or Other. Payments Received or Made with a Profile Type of Client, Vendor or ARC/BSP are connected to an invoice. Payments Received or Made with a Profile Type of Other and Agent are not linked to an invoice and prompts for a journal entry.

There are five profile types for payments received and payments made - Client, Vendor, Agent, Other, and ARC/BSP.

Payments Received|Made|Deposit|Withdrawal

General Tab

|

Client |

Entering client payments update specific client account balances and are either applied to specific ARC/BSP and Supplier type invoices entered into the system, left unapplied or turned into a voucher, crediting the client’s account. Any pending client balances appear on the report called Client Balances found in Reports|Core. To maintain accurate client balances (one of the Core Reports of the system) all invoices and client payments received and made must be entered into Trams Back Office. |

|

|

Vendor |

Entering Vendor (Submit to of) Supplier payments received and made update specific vendor account balances and are usually applied to specific Supplier type invoices entered into the system. Any pending vendor balances appear on the report called Vendor Balances found in Reports|Core. To maintain accurate vendor balances (one of the Core Reports of the system) all Supplier type invoices, as well as all Vendor-Supplier payments received and made, must be entered into Trams Back Office. Entering Vendor (Submit to of) Comm Track payments clears any tickler files created by Commission Tracking type transactions entered into the system. Comm Track-type bookings do not update the General Ledger until they have been closed with a Vendor payment. |

|

|

Agent |

Payments can be received from agents for reimbursing the agency for expenses such as a special gift sent to a customer which was purchased with agency money. Payments can be made to agents for expense reimbursement. These transactions do not apply to an invoice and would require a journal entry to update the general ledger. |

|

|

Other |

Other payments are entered when money is received or made which does not pertain to a client balance, a vendor balance, or any Comm Track type bookings. Examples are agency expenses and miscellaneous receipts. |

|

|

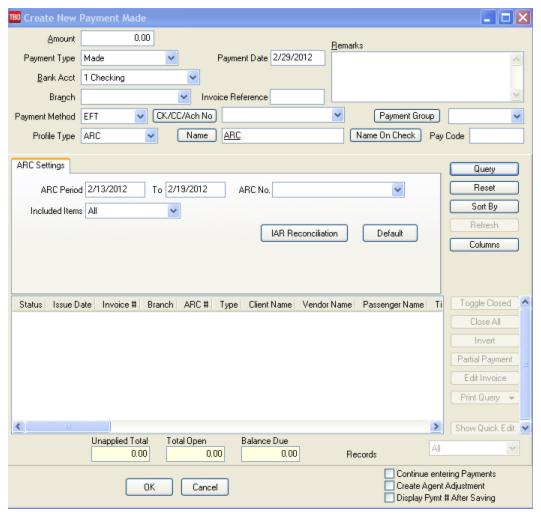

ARC/BSP |

Approximately five days after submitting the ARC/BSP report, ARC/BSP either deposits or withdraws payment to/from the agency’s bank account. By performing an ARC/BSP Settlement in TBO (see section below), Core Reports of ARC/BSP Balances and Check Register are updated. |

|

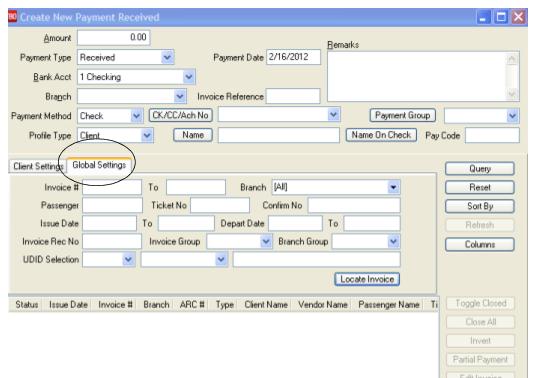

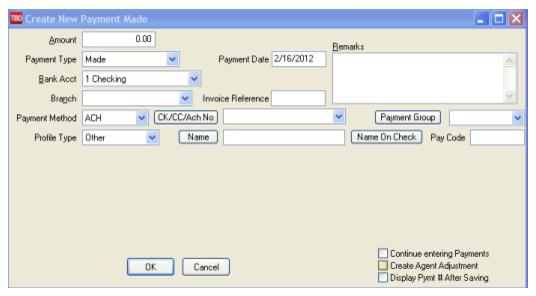

Payment Received/Payment Made Fields

|

Amount |

Enter the Payment amount received/made from client or vendor, deposit or withdrawal amount. |

|

|

Payment Type |

Select Received, Made, Deposit, Withdrawal. Important Note: Enter Payments Received, Made, Deposits, Withdrawal and perform an ARC/BSP Settlement from the same screen without having to return to the Main Menu. |

|

|

Payment Date |

Enter the payment date manually or by clicking the mouse on the date field to display a calendar. Note that the default date is the date entered for the most recently entered payment. The default date for the first entered payment is the system date. |

|

|

Bank Acct |

A number is assigned to each Bank Account. Enter appropriate Bank Account number for the payment or select from pull-down menu. A default bank account can be set up in Utilities|Setup|Global Defaults|Prompt. |

|

|

Branch |

Associate a branch from the drop-down menu with this payment if desired. This can be used for query and sort purposes in Payments, Bank Rec, Receipts, Payment Analysis, Client Statements, Vendor Statements, etc. Assign a branch to a payment if desired and still close out invoices created in more than one branch. |

|

|

Invoice Reference |

Enter an invoice reference when applicable. A warning comes up when saving a payment to the same profile where this Invoice Reference is the same as another existing payment under that profile. (This is an aid in not paying the same expense vendor twice for the same invoice or statement.) |

|

|

Date Cleared |

Date payment is cleared in the bank or credit card reconciliation process |

|

|

Remark |

500 spaces are allocated for free flow alphanumeric remarks. Click the scroll button at the end of the Remarks field to view multiple lines of remarks. These Remarks can also be used as criteria in a query screen. When checks are printed by Trams Back Office, if desired, these remarks appear on the check. |

|

|

Payment Method |

Click the down-arrow and highlight Cash, Check, Credit Card, Other, CC Merchant, EFT - stands for Electronic Funds Transfer, or ACH - Automated Clearing House. The system defaults to a payment method of Check. Use CC Merchant when the agency is processing a credit card. (See section of this chapter entitled Pay Method for Agency Processed Credit Cards for more details. See section of this chapter entitled Electronic Funds Transfer for further details about EFT payment methods, and Automated Clearing House about ACH payment method.) |

|

|

Credit Card/Check Number |

If the Payment Method is Check, enter the check number. If the payment method is Credit Card, enter the credit card number. If the payment method is CC Merchant, enter the credit card number\expiration date and the slash (\) is important. If the credit card is listed in the client profile, click the down arrow and select the credit card. A credit card can be added directly to the client profile from the payment screen by clicking the Check/CC no. button on the payment screen. |

|

|

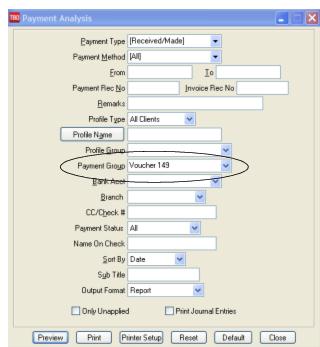

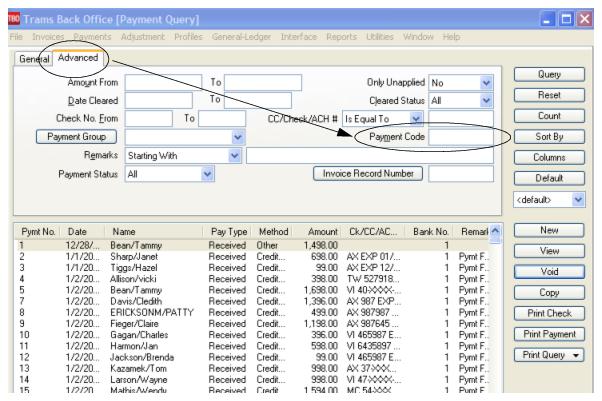

Payment Group |

This field assigns a unique group name to a group of invoices for selecting in a query or filtering for reports. To create a new payment group from the payment screen, click the Payment Group button. |

|

|

Profile Type |

Click on the down-arrow to select among Client, Vendor,Agent, Other, or ARC. (See section Payment Profile Types above.) |

|

|

Name |

Enter name or a portion of the profile name. Click the down-arrow and Trams Back Office displays a list of all potential names. To select a name from the list, highlight and click on the correct name. If there is no match, there is a TBO message, No matching Profiles found. Do you wish to create a new Profile? Click No and re-try the search, or enter an entire name and select Yes to create a new profile. When finished with the new profile, click OK and return to payment input. Also search by ID by a right click of the mouse in the name field. Query for a name by clicking the mouse on the “Name” field. |

|

|

Name (and/or Address) on Check |

If the name (and/or address) on the check differs from the name (and/or address) of the client, enter this information here for reference. (The profile name and/or address does not change as a result of entering the check name/address here.) |

|

|

Payment Code |

For recurring payments, assign a unique payment code for later selecting in a query and for easy duplication. |

|

|

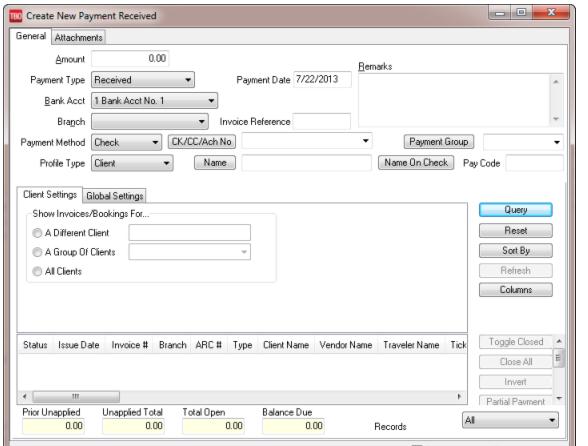

Client Settings/ Vendor Settings Tab |

With a Profile Type of Client, select invoices for A Different Client, A Group of Clients, or All Clients. For example, a corporate account has a separate profile for each division. Each of the profiles has the same Client group code in the groups tab of the profile. By selecting A Group of Clients, the invoice listing screen reflects any open invoices from all profiles in the group. The receipts report shows a single payment that matches the amount of the check received. With a Profile Type of Vendor, select a Submit To of All, Supplier, Comm Track and/or a Date Payable, A Different Vendor, A Group of Vendors, Vendors by Interface ID, or All. For example, a hotel franchise may have multiple vendor profiles. Each of these profiles has the same Vendor group code in the groups tab of the profile. By selecting A Group of Vendors, the invoice listing screen displays any open invoices from all profiles in the group. This can be used if only one payment is needed to be assigned to the payment received. Multiple vendors can also be displayed by selecting Vendors by Interface ID and entering a hotel chain code such as HI. This displays all invoices from all vendor profiles that start with HI. |

|

|

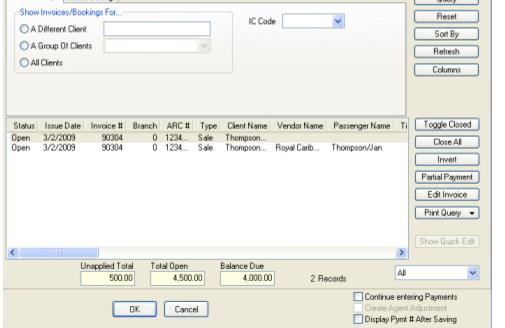

Global Settings Tab |

Select invoices by Invoice # or range, Branch, Passenger, Ticket No.,Confirmation No., Issue Date or Depart Date From/To, Invoice Group, UDID criteria and more. The invoice listing reflects the narrowed down results of the entered filter information. (The branch field on the Global Settings tab of the payment screen defaults to the branch specified at the payment level; if no branch is specified, then all branches are selected.) Click Locate Invoice to find invoice in the invoice query screen. This is used when the invoice number is known or other information about the invoice for the payment being received, but are not sure which Client Name the invoice is under. Once the invoice is located from the Query Screen and selected, the payment screen is populated with the correct Client Name. Only the invoice selected is displayed. |

|

|

Records |

Select All, Invoice Only, or Bookings Only. |

|

|

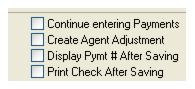

Continue entering payments |

To enter multiple payments at one time, make sure Continue Entering Payments is checked. When entering the last payment, remove the check to return to the main menu instead of the payment entry screen. |

|

|

Create Agent Adjustment |

When the profile type is Agent or Other, a window appears from which an agent commission or payment adjustment can be made. |

|

|

Display Pymt# After Saving |

If checked, the system prompts with the payment number when saving a payment so that number can be recorded. |

|

|

Print Check After Saving |

When creating a Payment Made, the Print Check after Saving check box is located in the lower right-hand corner of the payment screen. Once the option is enabled it will stick until the check mark is removed. When the payment (and journal entry) has been saved, the Check Writer dialogue box is launched and behaves in the same manner as when used from the Reports|Payments|Check Writer area. |

|

After entering a payment to or from a client or vendor, the system displays open invoices and any account balances applicable to the source of the payment when clicking Query.

Columns is used to select columns of data to display in the results screen. Click Columns and choose the columns by highlighting the column in the Available Fields and clicking the right arrow to move it over to Displayed Fields. Using the red up and down arrows, put the columns in the order to appear. Click OK. Return to the results screen and size the columns as desired, go back into Columns and click Save Settings and OK to save. Column settings can also be saved in the Edit Payments screen. Next click Sort to sort the columns of data displayed by up to 3 different fields in ascending or descending order. Click Save Settings.

Note: The column Net Due changes depending on how the invoices and bookings are viewed from the Client side, or bookings from the Vendor side:

From the Client Side:Net Due is “0” when looking at Supplier Invoices unless Partial Payments have been entered against the invoice. When looking at supplier bookings, Net Due equals the amount owed by the client for the booking and is the same as Total Fare.

From the Vendor Side: Only bookings are displayed and Net Due is the amount of the Total Fare less any Commission on a supplier booking and the amount of Commission due on a comm track booking.

All the payment screens are non-modal, meaning that screens can be clicked off while open so another task can be performed in the program. The payment screen is saved on the file menu under Window and can be re-opened. For example, when entering a commission payment received and all invoices are not displayed, minimize the payment screen and create a new invoice. Click /Window on the file menu and reopen the payment screen and click on the Refresh button and the new invoice is displayed.

Note: The payment number is not assigned until the payment is saved. This allows for sequential numbering for all the payments created in TBO.

ATTACHMENTS TAB Fields

In TBO version 3.05, an attachment tab has been added to all profile (Client, Vendor, Agent, Other), all invoice types (sale, refund, adjustment) and the payment screens. The tab is located adjacent to the tab now named General at the top of each screen. Within the workspace area of the new attachment tab, users can manage (add, view, delete, update) electronic documents of any type.

|

Filename |

Click the browse button to locate to the desired file. |

|

Compressed |

Defaults to enabled. Compressing the file helps to reduce the file size (maximum file size is 8MB). |

|

Description |

Enter a user-defined description. |

|

Path |

This field is automatically populated based on the location of the file. |

Add, adds a new file; Update, updates the existing file with a new or updated file; View, opens the file; and Delete deletes the attached file. Extract sends a copy of the attachment to a location on your computer.

Payments Received From (or Made To) Clients

Once a client is selected, that client's account balances appear on the screen, including a detailed listing of all open invoices and bookings for Sale, Refund, and Voucher. Note that positive amounts indicate payment due to the agency, and negative amounts indicate payment due from the agency. Note also invoices and vouchers are presented in blue, while bookings are presented in black.

Payment Received

Payment Received Columns

|

Prior Unapplied |

The accumulated total of unapplied funds the client had with the agency prior to this payment. Examples include past overpayments, pre-payments, or simply credits on account. Note: This area does not appear unless there are unapplieds in database, or if the Allow Client Unapplieds is NOT checked off in Utilities|Global Defaults|Prompt. |

|

Unapplied Total |

The total of the payment amount plus any prior unapplied; e.g., the amount available to apply towards open invoices. As invoices are closed, Unapplied Total is reduced accordingly. |

|

Total Open |

The amount due for all open invoices displayed. Sales invoices add to this total; refund invoices subtract from this total. As invoices are closed, Total Open is reduced accordingly. |

|

Balance Due |

Total Open less Unapplied Total. Amount owed or balances outstanding. A positive Account Balance represents money owed to the agency from the client; negative Account Balance represents money owed from the agency to the client. |

|

Records |

All displays both Invoices and Bookings on screen. Invoices are shown in blue; bookings are shown in black. Invoices Only shows invoices in blue. Bookings Only show the bookings in black. |

|

Invoice Number, Issue Date, Amount, and Status, and all other selected columns. |

A list of open invoices and/or vouchers for the identified client where the Invoice|Voucher Issue Date does not exceed the Payment Date. The information displayed are the columns selected in the order they were selected. (See details above.) |

Right-Mouse Click to Void a Booking in Create New Payment

Highlight any ARC/BSP, Supplier or Comm Track Booking in the results screen, and right-click to select Void Booking. A booking can be voided without having to use Edit Invoice. (Using Edit Invoice requires selecting that button, clicking OK to close the booking window, clicking Void on the invoice screen, and clicking OK to save the edit and get back to the Payment screen.) Right-mouse clicking saves over 4 key strokes/mouse-clicks! (All present requirements for voiding a booking are in effect. Can't void if a payment is attached until voiding the payment, and can't void in a closed period. The Void Booking feature from the Payment Screen will be disabled for non-booking items (invoices) including client & vendor voucher bookings.)

Payments Received from Client (Steps)

1. Select Payments|Received.

2. In the Amount field, type the dollar amount.

3. Change the Payment Date if necessary by typing in the proper date or clicking the mouse in the date field to display a calendar.

4. In the Branch field, associate a branch from the drop-down menu to the payment if desired.

5. In the Bank Acct field, type in the appropriate bank account number (1, 2, 3, etc.), or click the arrow and select from the list.

6. In the Remark field, type in free flow information, or leave blank.

7. Click the arrow by Payment Method field to choose the form of payment (Cash, Check, Credit Card, etc.)

8. If the payment method is Check or Credit Card, type in the check number or credit card number in the Check/CC No field.

9. If this payment is associated with a group, select the group name from the drop-down menu of the Payment Group field.

10. Change the Profile Type to Client.

11. In the Name field, type in the client’s name or a portion of the profile name and select name from the drop down menu. If there is no match, Trams Back Office prompts to build a new profile. (See section, Entering Client Profiles in the Profiles chapter.)

12. To narrow the list of open invoices, click on Client Settings and/or Global Settings. Use any or all of these fields or, skip this portion altogether. Click Query to display the open invoice(s) and booking(s).

13. To apply the payment, highlight the invoice|voucher to which the payment applies and click Toggle Closed, closing the invoice|voucher. Note that when closing the booking, both Unapplied Total and Total Open are reduced accordingly. Continue closing invoices|vouchers until all Invoices|Vouchers attached to the payment have been closed.

Warning: Do not close invoices unless Unapplied Total is at least as much as the invoice|voucher total to be closed. If the invoice|voucher is closed, and the client is left with a balance due, there is no invoice data to support the balance. The system does not allow a negative unapplied balance. Also, note that an unapplied balance is not allowed when the form of payment is credit card.

Applying Payments to Specific Invoice Bookings

Toggle between three views of the displayed invoices in a payment screen. The default view is All where each invoice and booking is represented by one line in the list (invoices and vouchers are in blue, and bookings are in black). The alternate views are Invoices Only or Bookings Only where each invoice or booking on an invoice is represented by one line in the list. To toggle between the three views, select All, Invoices Only or Bookings Only. When viewing by booking, Individual bookings can be closed without closing an entire invoice. If individual bookings are closed on an invoice, only open bookings show when later payments are entered. Individual bookings on the same invoice can be closed with different payments.

Payment Received Using Invoice/Payment Group

If Invoice/Payment groups have been created in Utilities|Setup|Groups or by clicking on Payment Group raised button in the payment screen, this table can be used in the Payment Group field pull-down menu and also the Invoice Group field under Global Settings.

By using the Global Settings Tab and selecting an invoice/payment group, filter and display only those invoices for the selected group. The invoice remarks and group fields, which are entered on the invoice header when first entering the invoice screen, can also be displayed if selected as displayed fields under Columns. This assists in applying a payment to the proper invoice(s)/voucher(s), based on the information entered in the Global Settings Tab and Invoice Group field.

|

You have received a payment from Bob Jones for his trip with the Hughes Cruise Group. Bob is a frequent traveler and has several open invoices. When you enter his payment, click on the Global Settings Tab and select the invoice group by clicking the down arrow in the Invoice Group field. Click "Query" and only the invoices that are associated with the Cruise Group will be displayed. You then can apply the payment to the proper group invoice. |

Payment Received Group

The Group Codes used in this feature can be entered from the Trams Back Office keyboard or by using the interface from the GDS.

Modifying Pymt Amt Once Account Balances Appear

Modify the payment amount entered while viewing account balances by changing the amount at the top of the screen.

Partial Payments

To apply a partial payment, click Partial Payment. Enter the amount of the partial payment and click OK.

G/L Branch Defaults

If a specific bank account references a G/L Branch, then that branch is used; otherwise, if the specified payment branch references a G/L Branch, then that branch is used. If neither of these apply, the default G/L branch is used set up in Utilities|Setup|Global Defaults|Prompt tab.

Close All/Invert All

To close all invoices at one time, click Close All. To invert (make closed payments open or vice versa), click Invert All.

Show Quick Edit

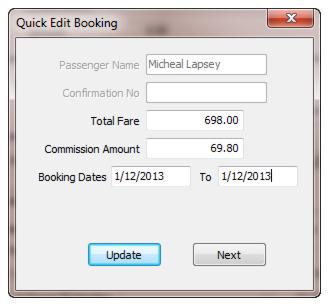

A Show Quick Edit button assists with streamlining when entering commission track payments. When entering a payment received or made with a profile type of Vendor, the Quick Edit button is enabled. A floating window is launched which users can position anywhere on the payment received screen. The window displays the passenger name and confirmation number which are non-editable as well as the commission amount and booking dates (depart/return dates) that are editable. By modifying the Total Fare totals here, the total fare field in the actual booking is changed to reflect the new amount.

Note: The agent commission percentage or amount is copied from the original supplier booking. Check and/or adjust the agent commission before saving the booking.

Once information has been edited, upon clicking the update button the booking is toggled closed and the next transaction in the grid is displayed in the quick edit screen. The next button moves to the next transaction in the query grid.

The quick edit button allows editing for commission track items where there are no agent payment dates in place.

Viewing/Editing Invoices by Booking

While viewing invoices by booking, access and modify the original booking by highlighting the booking and clicking Edit. When finished modifying the booking, click OK.

How to Use Client & Global Settings

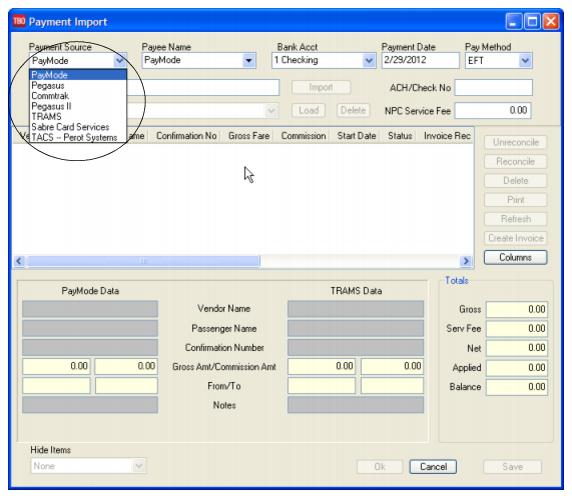

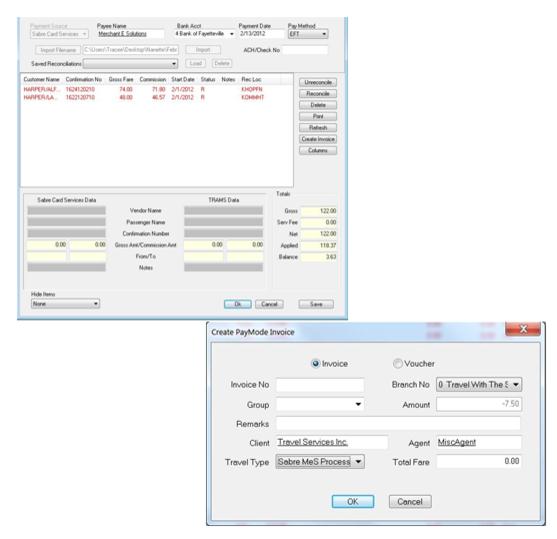

To receive a commission check from a payment source that covers multiple vendors such as PayMode, Marriott Hotels, Hilton Hotels, etc.:

1. Enter the payment received information for the check as normal.

2. Change the Profile Type to “Vendor”.

3. Change the Submit To field on the Vendor Settings tab.

If only “Comm Track” bookings are needed to apply the check to, select Submit To, “Comm Track”. If only “Supplier” bookings are desired to apply the check to, select Submit To of “Supplier”. To see both “Comm Track” and “Supplier” bookings to apply the check to, select Submit To of “All” on the Vendor Settings tab. This will close both Comm Track and Supplier bookings using the same check on a single payment.

4. Select A Group of Vendors field on the Vendor Settings tab and enter the appropriate “Group” in the field (PayMode, MC, HILTON etc.) These vendor groups are created under Utilities|Setup|Groups.

5. From the Global Settings tab, you can filter your query on a UDID Number with the dropdown or type in a UDID number (or partial number) and land on the desired UDID more quickly than by scrolling through the list. The UDID Description is for those who prefer to search by description. Selecting a value in either dropdown will update the corresponding UDID value in the other dropdown.

6. Add a Profile Name for the Group Vendor in the Name field - PayMode, Marriott Hotels, Hilton Hotels etc.

Important: Each single payment source - PayMode, Marriott Hotels, Hilton Hotels, etc. needs a vendor profile even if no invoices will be created under that profile. The profile is only used to reflect the centralized payments received from this single payment source.

7. Click Query and close off the appropriate queried bookings,and save the payment as normal.

Note: The same procedure would apply for receiving a single check paying for invoices under two or more Grouped client profiles. Just enter client group name in the Group of Clients field instead of vendor information.

Hint: Notice the field Vendors by Interface ID. This field searches for the first two characters of the Vendor Interface ID. This is an alternative time saver for finding multiple hotels in a single chain without having to link them all together using the Groups field in each Vendor profile. For example, by entering HI in the Vendors by Interface ID field, all vendors that have an interface ID beginning with HI will be displayed.

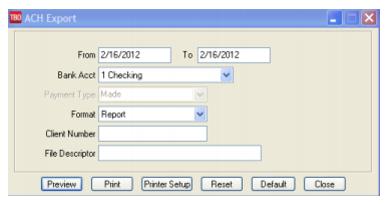

Automated Clearing House (ACH)

Automated Clearing House (ACH) is a system set up by the Federal Reserve Banks in the United States for standardizing the transfer of electronic payments between banking institutions. This Payment Method can be used for handing off data from Trams Back Office to a Payment Distribution Service or the agency’s bank. (This is like a PayMode settlement using EFT, but in reverse.) Instead of the agency receiving a file to reconcile payments being received, the agency sends a file, so that expense payments or payments to a vendor can be made from the file by a bank or Payment Distribution Service. Using a Payment Method of ACH acts like an EFT payment and appears directly on the Check Register and on the Bank Reconciliation. Both Payments Received and Payments Made can be created, however only Payments Made can be exported to a file. The file output conforms to the NACHA format.

Payment Made - The payment can be included in the ACH Export file sent to a bank or Payment Distribution Service for processing. These payments when processed by the agency’s bank or Payment Distribution Service would appear on the bank statement as an EFT payment and would be cleared when doing a Bank Reconciliation.

An ACH Payment Made could be used to electronically pay Vendors that would allow for an electronic payment to them, and to make expense payments for goods and services the agency purchases, like the electric or gas bill.

Payment Received - Not Currently Implemented. Create a payment received using ACH, but the payment cannot currently be included in the ACH Export file sent to a bank or Payment Distribution Service for processing. Therefore the amount of the payment would not show on any bank statement and could not be cleared when doing a Bank Reconciliation. When implemented, an ACH Payment Received could be used by an agency to collect fees from another entity, or for a larger agency chain to collect monthly licensing fees.

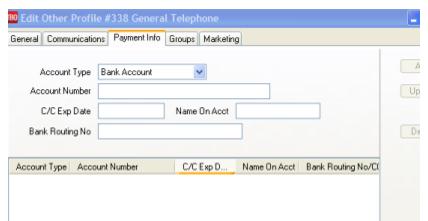

Profiles - New fields have been added under Bank Account Settings, on the Payment Info tab of all profile types for Bank Account and Routing No. The Routing Number field is composed of both the Bank Code and the Bank Branch. The first four (4) digits are for the Bank Code and the last five (5) digits are for the Bank Branch. In the US those two numbers are usually combined into one nine (9) digit Routing Number. In other countries the Bank Code and Bank Branch may be separate numbers. If so, enter both in the Routing Number field with no spaces or dashes. Enter all nine (9) digits including any 'leading' zeros if present.

|

From/To |

Enter a date range for export file. |

|

Bank Acct. |

From the drop-down menu, select the appropriate bank account. |

|

Payment Type |

By default, the Payment Type is hard-coded as Made. |

|

Format |

From the drop-down select report or file. |

|

Client Number |

Enter a the client number (this is the client account number issued by the bank. |

|

File Descriptor |

Type the file name format supplied by the bank. |

Workflow Scenario

1. Agency creates a payment made in Trams Back Office

2. Agency creates an ACH export to send to the Agency's Bank.

3. Agency Bank processes the file which updates the bank account for the Payee in the payment made.

Detailed Steps

1. Create or Query a Profile for the Payee

a. Enter the Payee's Bank information into the Payment Info tab of the profile in the Account Number field

2. Create a payment made as usual

a. Payment Method = ACH

b. Click on the CK/CC/ACH button to access the ACH Account Number information in the Payee profile

c. In the Payee profile, copy and paste the Account Number into the CK/CC/ACH field of the payment made

3. Obtain the Agency client account number from the Agency bank. (This information will be used when performing the Reports|Payment|ACH Export in the Client Number field)

4. Obtain file descriptor (file name format supplied by Agency bank, if they require it). (This information will be used when performing the Reports|Payment|ACH Export in the File Descriptor field)

5. Go to Reports|Payment|ACH Export

6. Enter the date range for the ACH payments created to be included in the Export

7. Select the appropriate Bank Account from which the funds will be withdrawn

8. Select the Format option: File

9. Enter the Client Number from step 3

10.Enter the File Descriptor from step 4

11.Click on preview which will display the save in dialogue box

12.Select where to save the file and enter a file name in the file name field

13.The Save as Type field will be text (.txt)

Electronic Funds Transfer

Record payments made or payments received for EFT’s, or for electronic withdrawals. Select Payments/Received or Made from the main menu. Enter the amount and click the down arrow next in the Payment Method field to select the option for EFT. Enter the Pay Date, Remarks, Profile Type and Name.

A Payment Received with a Pay Method of EFT, does not require a deposit entry. These items are automatically added to the check register. A Payment Made with a Pay Method of EFT, does not require a withdrawal entry. These items are automatically deducted from the check register. Use the Remark line in the payment screen, to identify each EFT payment. The Remark field prints on the check register, making reconciling the bank statement easier. ARC/BSP Settlement, Bank Transfers, and Vendor withdrawals, use the Pay Method EFT. Note: Bank transfers can also be done using the Form of Payment, Check.

|

Your agency subscribes to Trams Back Office and pays monthly with an EFT. You have recorded this payment as a Payment Made in the amount of $90 with a Pay Method of EFT and a Profile Type of Other. The profile Name is Trams Back Office. Because the profile type is Other, you are prompted for a journal entry. Enter the off-setting expense account, add a debit for $90, and click on OK. This EFT entry appears on your check register as an EFT W/D. |

Overpayment from a Client

When a payment is received from a client for more than the amount owed, the overpayment is left on the client’s account as a voucher. (See voucher section also in this chapter.)

1. Click Payments|Received. Enter the payment received as usual.

2. When the invoice(s) appear, close them as usual.

3. Trams Back Office prompts, “Unapplied Payment Option. Create Voucher, Leave Unapplied, or Cancel.” Click the Create Voucher button.

4. Enter the voucher information as usual. (See Entering a Voucher in this chapter.)

5. Click OK to save.

Split Forms of Payment for Client Invoices

When one booking on an invoice is paid by credit card and another booking is paid by cash/check, separate payments are required. If invoice has already been entered. Select All or Bookings Only for the records.All displays both Invoices and Bookings on screen. Bookings Only show the bookings in black.

1. Select Payments|Received from the Main Menu.

2. In the Amount field, type in the dollar amount.

3. Change the Payment Date if necessary by typing in the proper date or clicking the mouse in the date field to display a calendar.

4. In the Branch field, associate a branch from the drop-down menu to the payment if desired.

5. In the Bank Acct field, type in the appropriate bank account number (1, 2, 3, etc.), or click the arrow and select from the list.

6. In the Remark field, type in free flow information, or leave blank.

7. Click the arrow by Payment Method field to choose the form of payment Credit Card.

8. Enter the credit card number in the Check/CC No field.

9. Enter Payment Group if applicable. (See Payment Group section of this chapter.)

10. Select Profile Type of Client.

12. In the Name field, type in a portion of the client's name.

13. To narrow the list of open invoices, use the Client Settings and Global Settings tabs. Use any or all of these fields or skip this portion altogether. Click Query to display the open invoice(s) and bookings.

14. Click the booking being paid by credit card and click Toggle Closed. Click OK to save.

15. Repeat the steps for the Cash/Check payment.

Partial Payment Received From Client

A partial payment in Trams Back Office is a payment received from a client that is less than the amount of the invoice.

1. Select Payments|Received from the Main Menu.

2. In the Amount field, type in the exact amount for that Form of Payment.

3. Change the Payment Date if necessary by typing in the proper date or clicking the mouse in the date field to display a calendar.

4. In the Branch field, associate a branch from the drop-down menu to the payment if desired.

5. In the Bank Acct field, type in the appropriate bank account number (1, 2, 3, etc.), or click the arrow and select from the list.

6. In the Remark field, type in free flow information, or leave blank.

7. Change the Payment Method field to Cash or Check.

8. If Payment Method is check, enter the Check number in the Check/CC No field.

Note: The Credit Card form of payment cannot be used for partial payments.

9. Enter the Payment Group if applicable. (See also Payment Group section of this chapter.)

10. Profile Type is Client.

11. In the Name field, type a portion of the client’s name.

12. Enter the Payment Code if applicable. (See also Payment Code section of this chapter.)

13. If there is more than one invoice listed, click the desired invoice want and click Partial Payment.

14. The Partial Payment Box appears. Type in the amount to apply towards the invoice and click OK.

15. Partial payments can be applied to more than one invoice by repeating Step 13 and Step 14.

16. Click OK to save.

Note: Partial payments can be created against an invoice, but not the booking.

Transfer Funds from One Client Account to Another

Method A: This method can only be used if the payment is in an accounting period that has not been closed. If an End of Period has been created and posted, proceed to Method B. Example: Transferring $50.00 from Jon Smith to Clara Williams:

1. Select Payments|Query|Payment and query the payment that needs to be transferred. (i.e. payment for Jon Smith.)

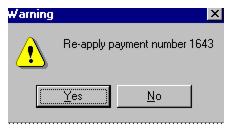

2. Once the payment is displayed, highlight it and right mouse click. When the menu choices appear, click Re-Apply.

3. Trams Back Office prompts, “Re-apply payment number xx” and click Yes. This voids the original payment and copies the information into a new payment screen.

4. Change the date to the date the payment was originally deposited. The Payment Date defaults to the current date.

5. Click the name field and change the name to the person the money is to be transferred to. (i.e. Clara Williams.)

6. Click OK to save the payment.

Note: If the invoice is also applied to the profile, transfer the Invoice first and the payment automatically comes along with it--that way voucher does not have to be created!

Method B: This method is used if the payment is in an accounting period that was already closed and posted. To transfer money from one client’s account to another, enter a Payment Made from the client’s account from which the money is being taken and a Payment Received to the client’s account to which the money is being given. Example: Transferring $50.00 from Jon Smith to Clara Williams:

1. Click Payment|Made. Enter the payment as usual.

2. In the Amount field, type the amount being transferred (e.g. $50.00).

3. Payment Method is Other.

4. In the Remark field, type To Transfer Balance.

5. Profile Type is Client.

6. In the Name field, type in the client’s name (e.g. Jon Smith).

7. Click OK to save.

8. Trams Back Office prompts, “Create A Journal Entry?” Click YES.

9. Trams Back Office automatically displays a debit to Client Balances. Enter a credit against account 6900-Temporary Holding as the offsetting account. (Is this account created? See section, Add To The General Ledger Chart of Accounts in the Setting Up Trams Back Office chapter.)

10. Click OK to save.

11. Click Payments|Received. Enter the payment as usual. (See Payments Received From Client section in this chapter.)

12. In the Amount field, type the amount being transferred (e.g. $50.00).

13. Payment Method is Other.

14. In the Remark field, type “To Transfer Balance.”

15. Profile Type is Client.

16. In the Name field, type in the client’s name. (e.g. Clara Williams)

17. Click OK to save.

18. Trams Back Office prompts, “Create A Journal Entry?” Click YES.

19. Trams Back Office automatically displays a credit to Client Balances. Enter a debit against account 6900-Temporary Holding as the offsetting account.

20. Click OK to save.

Remove/Write Off Client Balance

1. Go to Payments|Received.

2. Enter the Amount of invoice to be removed/written off.

3. Use date of report run to detect balance.

4. Choose Payment Method of OTHER.

5. Under Remarks, type "Write-off” with additional explanation.

6. In the Name field, enter the Client Name.

7. Toggle the invoice closed by clicking Toggle Close.

8. If the GL is set up, create a JE which credits Client Balances and write it off as a debit to a bad debt account (usually a 6xxx account).

Remove/Write Off Vendor Balance

1. Go to Payments|Made.

2. Enter the Amount of Invoice to be removed/written off.

3. Use date of report run to detect balance.

4. Choose Payment Method of OTHER.

5. Under Remarks, type “Write-off” with additional explanation.

6. In the Name field, enter the Vendor Name.

7. Toggle the invoice closed by clicking Toggle Close.

8. If the GL is set up, create a JE which debits Vendor Balances and write it off as a credit to a bad debt account (usually a 6xxx account).

Gift Certificate

To record the purchase of a gift certificate:

1. Click Payments|Received.

2. In the Amount field, type in the amount of the payment received to purchase the gift certificate.

3. In the Payment Date field, type in the date the payment is being deposited.

4. In the Bank Acct field, type in the appropriate bank account number (1,2, 3, etc.), or click the arrow to select from list.

5. In the Remark field, type Gift Certificate and if available the Gift Certificate number. These remarks can be used as criteria in a query screen.

6. In the Payment Method field, click the arrow to choose cash or check.

7. If the Payment Method was Check, type in the check number in the Check/CC No field.

8. Enter Payment Group if applicable. (See also Payment Group section of this chapter.)

9. Enter the Payment Code if applicable. (See also Payment Code section of this chapter.)

10. Profile Type is Client.

11. In the Name field, type in the name of the client. Click OK (not Query).

12. If there are no open invoices for the client, proceed to step #13. If there are open invoices click OK again, then proceed to step #14.

13. TBO prompts Profile Has No Open Invoices Prior to Payment Date. Create Voucher, Leave Unapplied, Cancel. Choose Create Voucher.

14. Fill in Voucher information and click OK to save.

Note: If one person is purchasing the gift certificate for another person, Trams Back Office recommends that the payment be recorded under the name of the person doing the traveling. This establishes a credit balance for the correct client account. If the name of the person traveling is unknown, record the payment under the name of the person who purchased the gift certificate. When the gift certificate is redeemed, the balance may be transferred from one account to the other or choose All Clients from the Client Settings in payment screen and close voucher and invoice from the two different client profiles.

Petty Cash

Giving Change from Petty Cash

When a client pays for an invoice and change is given out of Petty Cash:

1. Click Payments|Received and enter the payment from the client, as usual, for the actual amount received. (If the invoice is $75.00 and the client pays $80.00, enter the payment received as $80.00.)

2. When Trams Back Office displays the open invoice(s), click Toggle Closed to change the status of the invoice(s) to closed. Click OK to save.

3. Trams Back Office prompts, “Total Unapplied is (whatever the amount is). Create Voucher, Leave Unapplied, Cancel.” Click Create Voucher. (If the invoice is $75.00 and the client pays $80.00, once the invoice is closed the extra $5.00 shows as unapplied. This amount goes on the voucher.)

4. Enter a Payment Made to the client, as usual, for the voucher amount ($5.00). Payment Method is Other. Trams Back Office displays the voucher. Highlight it and click Toggle Closed. Click OK to save.

5. Trams Back Office prompts, “Create A Journal Entry?" Click YES.

6. Trams Back Office automatically displays a debit to Client Balances. Choose the Over/Short account as the offsetting entry. It may be necessary to create this account. (See Adding to the General Ledger Chart of Accounts section in the General Ledger chapter.)

Example Journal Entry

Acct #

Name

Debit

Credit

1100

Client Balances

5.00

6XXX

Over/Short

5.00

7. Click OK to save.

The Over/Short account is cleared when petty cash is reimbursed. (See Reimbursing Petty Cash section in this chapter.)

Note: Make sure to put a receipt in the petty cash drawer to account for the money that was taken out for the change.

Reimbursing Petty Cash

To replace the money taken from petty cash:

1. Click on Payments|Made.

2. In the Amount field, type in the dollar amount.

3. In the Bank Acct field, type in the appropriate bank account number (1, 2, 3, etc.), or click the arrow to select from the list.

4. Change the Payment Date (if it is not the current date) by typing in the proper date.

5. Click the arrow to choose the Payment Method of Check.

6. Type the Check number in the Check/CC No field.

7. Leave the Payment Group field blank.

8. Leave the Payment Code field blank. (See Payment Code section in this chapter for more information.)

9. In the Remark field, type in Petty Cash Reimbursement.

10. Change the Profile Type to Other.

11. In the Name field type in Petty Cash. If there is no match, Trams Back Office prompts to build a new profile. (See Other Profiles section in the Profiles chapter.) Click OK to save.

12. Trams Back Office prompts, “Create a Journal Entry?” Click YES.

13. Trams Back Office automatically displays a credit to the Cash in Bank account. Offset this against the appropriate expense account(s) that represent the various items for which petty cash was used.

Example Journal Entry

Acct #

Name

Br

Debit

Credit

1000

Cash in Bank

100.00

6150

Office Expense

90.00

6180

Postage

10.00

14. Click OK to save.

Note: Journal Entries created directly against the General Ledger account for Petty Cash are done only to set up Petty Cash, or increase/decrease the overall Petty Cash balance carried. Journal Entries are never entered against this account when reimbursing.

Owner/Employee Travel Expenses Paid by Agency

For travel expenses absorbed by the agency, such as FAM trips, seminars, or special classes, enter an invoice as usual.

1. Click Invoices|Sale. Complete the invoice as usual. (See Entering a Sales Invoice section in Invoice chapter.)

2. Once the invoice is complete, click Payments|Received.

3. In the Amount field, type in the dollar amount of the invoice.

4. Change the Payment Method field to Other.

5. Change the Payment Date field (if it is not the current date) by entering the correct date.

6. Since the Payment Method is Other, it is not necessary to modify the Bank Acct field. Skip this field.

7. Enter the Payment Group if applicable. (See also Payment Group section of this chapter.)

8. Enter the Payment Code if applicable. (See also Payment Code section of this chapter.)

9. In the Remark field, type a brief description of what the payment is for. (e.g. FAM Trip, seminar, etc.).

Profile Type is Client.

10. In the Name field, enter the name of the person or entity as recorded on the invoice. (Owner or Employee’s name, Travel Agency’s name, etc.)

11. Click OK to process.

12. Trams Back Office displays all open invoices for the client. Click the invoice to close and click Toggle Closed. Repeat if there are multiple invoices to close.

13. Click OK to save.

14. Trams Back Office prompts, Create Journal Entry? Click YES.

15. Trams Back Office displays a credit to Client Balances. Fill in the offsetting GL account.

Example Journal Entry

Acct #

Name

Debit

Credit

1100

Client Balances

xx.xx

6xxx

Education & Seminars

xx.xx

16. Click OK to save.

Foreign Currency Payments

|

A Canadian agency has Bank Account 2 set up in US Dollars. A customer calls and is paying for a ticket with US Dollars. The price for the travel is $200.00 Canadian Dollars. The exchange rate in the conversion field is .800. Enter the invoice in local currency. The client is quoted $160.00 in US dollars. |

When setting up Bank Accounts, only use a currency code (like USD) on the bank account that there is going to be foreign exchange issued on, and it is recommended to leave the rate at 1.000 so that there is control of the equivalency based on the day’s rate. Add an asset account for Foreign Exchange to the Chart of Accounts and go to Utilities|Setup|GL Accounts to enter the new Foreign Exchange chart number in the Conversion Column for the agency bank account.

Trams Back Office automatically generates the journal entry if the G/L Prompt default settings are set to Recommended|Always (Refer to Utilities|Setup|Global Defaults).

This transaction creates the following EOP entry:

|

EOP Entry |

|||

|

Acct |

Account Name |

Debit |

Credit |

|

4000 |

Sales - Domestic Air |

|

200.00 |

|

1100 |

Client Balances |

200.00 |

|

|

5000 |

Cost of Sales Domestic Air |

181.82 |

|

|

2010 |

ARC/BSP Balances |

|

181.82 |

|

1000 |

Cash In Bank-US Dollars |

160.00 |

|

|

1001 |

Foreign Exchange |

40.00 |

|

|

1100 |

Client Balances |

|

200.00 |

If a payment is made to a vendor for $160.00 on a $200.00 Canadian net remit, the journal entry should read:

|

Acct |

Account Name |

Debit |

Credit |

|

1000 |

Cash In Bank-US Dollars |

|

160.00 |

|

1001 |

Foreign Exchange |

|

40.00 |

|

1100 |

Vendor Balances |

200.00 |

|

Payment Received for Commission Track

To record a payment for commission received from a Vendor (hotel, car, tours, etc.):

1. Click Payments|Received.

2. In the Amount field, type in the amount of the commission check received.

3. In the Payment Date field, type in the date the payment is being deposited.

4. The Bank Acct field should be the appropriate bank account number (1,2,3, etc.). To change the default, type in the new number, or click the arrow to see the list.

5. In the Remark field, enter free flow information.

6. Change the Payment Method to Check.

7. Type the Check number in the Check/CC No field.

8. If this payment is associated with a group, type the group name in the Payment Group field.

9. Enter Payment Code if applicable. (See also Payment Code section of this chapter.)

10. Change the Profile Type field to Vendor and in the Vendor Settings Tab select Submit To to CommTrack.

11. In the Name field, type in the name of the Vendor from whom the check was received.

12. To narrow the list of open invoices, select from the Vendor Settings and/or Global Settings tabs. Use any or all of these fields to locate an invoice(s), or skip this field entirely. If the payment is for a group of vendors select A Group of Vendors and select the group name. Click Query to display open invoice(s).

13. If there is more than one invoice listed, click the first invoice to close, then click Toggle Closed. Repeat until all appropriate invoices are closed.

Note: Sometimes the payment received from the Vendor differs from the amount invoiced. For Commission Track bookings, the amounts can be edited in the payment screen. Click the invoice to close, then click Edit Invoice. Change both the Commission amount and the Total Fare. If the exact amount of the Total Fare is not shown on the receipt, estimate (e.g. the commission check was $10.00 and earn 10% commission, the total fare is $100.00).

14. Click OK to save the changes to the booking.

15. Click OK to save the payment.

Commtrack Vendor Pays the Commission Due Agency via the Agency's Credit Card

If the vendor on a Commtrack invoice indicates that they want to pay the commission they owe by crediting the agency credit card, use the following steps:

1) Query the Commtrack invoice and view the booking. Change the total fare and commission to $0. Enter a payment received of $0 from the vendor with a payment method of Cash, and close the booking. If the Commtrack booking is voided, this may affect reports and the ability to track the booking activity with that particular vendor.

2) Enter a second payment received for the amount of the commission with a pay method of CC Merchant and a Profile Type of Other.

Debit 1150 - the CC Merchant Receivable account

Credit 4xxx Sales for gross amount

Debit 5xxx Cost of Sales for the net amount

3) When money is actually deposited into the bank account, enter payment received with pay method of and a Profile Type of Other.

Debit 1xxx for amount in bank

Credit 1150 full amount charge to cards

Debit 6xxx Credit Card fees or Bank fees for the processing fee amount

Commission Received - No Invoice

When a commission check is received and there is not a commission tracking booking in Trams Back Office (this usually happens with commissions coming in on bookings made prior to implementing Trams Back Office), there are two ways that the check can be recorded.

Option One: This option is the Trams Back Office recommended method, since it can track the history for the vendor.

1. Click Invoices|Sale.

2. Create a sales invoice as usual with the Submit To field as Comm Track. (See Entering a Sales Invoice in Invoices chapter.)

3. Next, click Payments|Received.

4. Enter the commission check as usual.

Note: Remember payment screens are non-modal. If in a payment screen and an invoice needs to be entered, minimize the payment screen, create an Invoice|Sale as above, click Window from main menu and reopen the payment screen. Refresh displays the newly entered invoice.

Option Two: With this option, no sales information is available for the management reports, nor will production volume be reported by Vendor or Client.

1. Click Payments|Received.

2. In the Amount field, type in the amount of the commission check.

3. Leave the Payment Method as Check.

4. In the Payment Date field, type in the date the payment is being deposited.

5. In the Bank Acct field, type in the appropriate bank account number (1, 2, 3, etc.) or click the arrow to the right of the field to select from list.

6. Leave the Name on Check field blank.

7. Type in the check number in the Check/CC No field.

8. Enter the Payment Group if applicable. (See also Payment Groups section of this chapter.)

9. Enter the Payment Code if applicable. (See also Payment Code section of this chapter.)

10. In the Remark field, type Commission Received.

11. The Profile Type is Other.

12. In the Name field, type in the name of the Vendor from whom the check was received. Click OK.

13. Trams Back Office prompts, Create A Journal Entry? Click Yes.

14. Trams Back Office displays a debit to Cash in Bank for the amount of the check.

The first offsetting account number should be the Sales account being affected. Credit that account for the gross sale amount. The next journal entry line is the account number for the Cost of Sales account being affected. Debit that account for the gross sale amount less the amount of commission received.

15. Click OK to save.

Note: When using this option, it may be necessary to estimate what the gross sale amount is. If a commission check of $10 is received from Alamo Car Rental and 10% commission is usually earned, the journal entry is as follows:

|

Debit |

Cash Account |

$10.00 (commission received) |

|

Credit |

Sales-Car |

$100.00 |

|

Debit |

Cost of Sales-Car |

$90.00 |

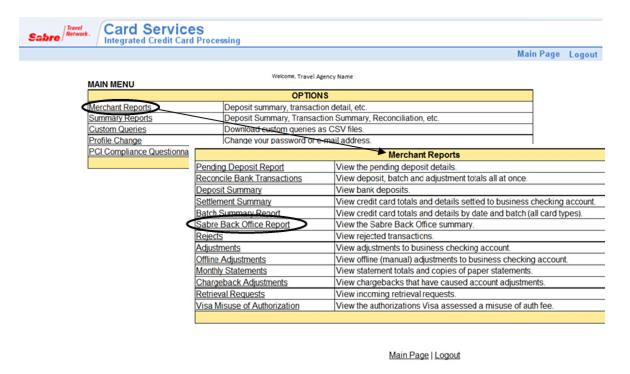

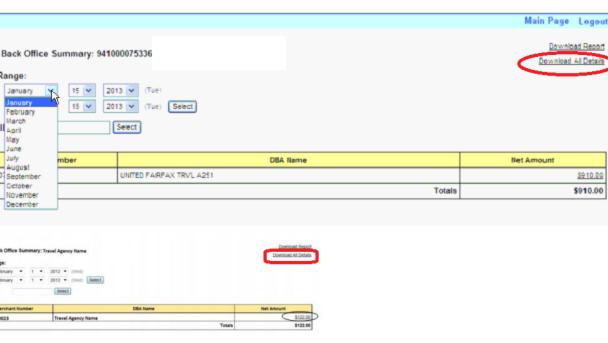

Entering Commission Payments Received from a Clearing House

Some hotels such as Marriott Hotels, Courtyard by Marriott, Fairmont Hotels, etc., belong to a clearing house such as Pegasus. These clearing houses issue commission checks for all hotels using their services. Therefore, one commission check is issued for all bookings to these hotels. Use the steps below to manually enter the payment. Pegasus, PayMode, and TACS (Perot Systems) offer files that Trams Back Office uses to automate this process. (See the Pegasus/PayMode/CommTrak/TACS Reconciliation section of this chapter.) To link the profiles:

1. Click Profiles|Query.

2. In the Vendor Name field, type in the name of the hotel belonging to the clearing house, (e.g., Marriott, Hilton, etc.).

3. Change Profile Type to Vendor. Click Query to see all hotels matching the name.

4. Highlight the profile and click View.

5. Click the Group tab. In the Group/Batch field, select a vendor group that has been created in Utilities|Setup|Groups (e.g, PayMode, Pegasus, TACS). Click Add to add it to the group list. Click the OK to save.

6. Repeat Steps 2 through 6 until all profiles are edited.

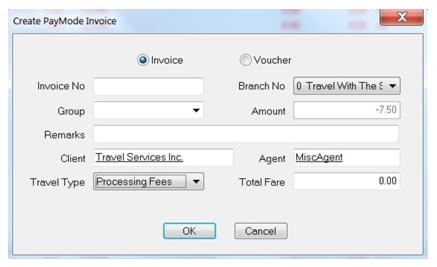

Create a Negative Sales Invoice for the Processing Fee

1. Click Invoices|Sale. Enter the invoice as usual (see Entering a Sales Invoice section in the Invoice chapter.)

2. In the Client Name field, type in the name of the agency. Submit To is Comm Track.

3. In the Vendor Name field, type in Pegasus. (If there is not a Vendor Profile, create one. Make sure to put Pegasus in the Group/Batch field of the profile.)

4. In the Commission/Rate field, type in the service fee amount as a negative number.

5. Click OK to save.

To Receipt the Payment

1. Click Payments|Received.

2. In the Amount field type in the amount of the check received.

3. Change Profile Type to Vendor.

4. In the Name field, type Pegasus

5. Under vendor settings select a Group of Vendors and from the drop down menu select Pegasus.

Note: Sometimes the payment received from the vendor differs from the amount invoiced. For Commission Track bookings, edit the amounts in the Payment screen. Highlight the invoice to close and click Edit Invoice. Change both the Commission/Rate amount and the Total Fare. If the exact amount of the Total Fare is not shown on the receipt, estimate (e.g., the commission check is $10.00 and 10% commission was earned, the total fare is $100.00). Click OK to save the changes made to the booking.

6. Highlight the invoice to close and click the Toggle Closed button. Repeat for all invoices being paid. Make sure to also close the service fee invoice. Click OK to save.

Note to Canadian Agencies

On the Pegasus Payment Import routine, the GST Amount and rate included in the Pegasus import file is read and altered in the more taxes tab to match the amount in the file. There is also a column for the Commission on GST on the Payment Import screen. The Pegasus Payment Import subtracts the GST Amount from the Commission Amount column. When the payment is closed, the Commission on GST field is updated.

Agency Processed Credit Card aka CC Merchant

There are two methods with which to account for Agency Processed Credit cards, also known as CC Merchant transactions: CC Merchant Vendor Bills for Service Charge and CC Merchant Vendor Deducts Service Charge at Time of Deposit. For both methods the End of Period journal entry summarizes all invoices with a pay method of CC Merchant and debits the default account 1105. Both methods reduce the total amount back to zero. Note: There is also a CC Merchant Automated CC Service Fee Processing utility (agencies that are processing credit cards with NTC (National Transactions Corporation), BluePay Canada (formerly Caledon), or Ticketmaster (no longer taking new customers), can process directly into TBO).

Account for CC Merchant Vendor Bills for Service Fee

The credit card charges are deposited directly into the bank account. The credit card company withdraws a processing fee periodically (Visa, MasterCard, Diners, etc.).

1. Enter the invoice bookings with submit to set to Supplier and record all pertinent information (travel type, vendor name, etc.)

2. Enter a payment received from the client with pay method set to CC Merchant. Enter the full amount of the payment, recording the credit card number and all pertinent information (date, client, etc.), and close the applicable invoice.

Note: This can also be accomplished through the Interface process from the GDS with a *CP4 code in the accounting line.

3. Print a Credit Card Merchant Report (Reports|Payments|CC Merchant) for the day, with Included CC’s set to Visa, MasterCard & Diners. Verify that the report matches the amount of the deposit.

4. Enter a payment received with a payment method of EFT for the deposit amount. Set profile type to other. A profile should be created for use specifically for this type of deposit. The journal entry is a debit to Cash in Bank and a credit to the Credit Card Merchant receivables account. (Create this account under General Ledger|Accounts in the 1000 series, if not already done.)

5. When the service charge from the credit card company is deducted from the bank account, enter that amount as a payment made with a payment method of EFT and profile type of other. The journal entry is a credit to Cash in Bank and a debit to Bank Fees.

Account for CC Merchant Vendor Deducts Service Charge at Time of Deposit

In this method, the credit card charges are reported to the credit card company. The credit card company then makes a deposit into the agency’s bank account, less any service fees (American Express).

1. Enter the invoice bookings with submit to set to Supplier and record all pertinent information (travel type, vendor name, etc.).

2. Enter a payment received from the client with payment method set to CC Merchant. Enter the full amount of the payment, recording the credit card number and all pertinent information (date, client, etc.) and close the applicable invoice.

Note: This can also be accomplished through the Interface process from the GDS with a *CP4 code in the accounting line.

3. Print a Credit Card Merchant Report (Reports|Payments|CC Merchant) with Included CC’s set to American Express. Verify that the report matches the amount of the credit cards that were processed.

4. When the credit card company sends a reconciliation report of the charges, enter a payment received with a payment method of EFT for the deposit amount. Set profile type to Other. A profile should be created for use specifically for this type of deposit. The journal entry will be a debit to Cash in Bank, a credit to the Credit Card Merchant receivables account (create this account under General Ledger|Accounts in the 1000 series if not already done) and a debit to Bank Fees.

|

Bob and Mary Jones are booking a tour with your agency. The total cost is $1000. They want to pay with their VISA Credit Card. This vendor does not take credit cards, so you process it directly, and pay the vendor with an agency check. To record this transaction, go to the main Payments menu, then to Received. Enter the $1000 in the Amount field. Fill in the date and change the Pay Method to CC Merch. Be sure to include the client credit card number because this lets you use the CC Reconciliation to clear the CC Merch payments. Fill in any necessary remarks, change the Profile Type to Client, and type Jones in the name field. When the $1000 tour invoice appears, press <Enter> to close it, and click on OK. When VISA deposits this money in your bank account, go to the main Payments menu, then to Received. Enter the amount, and select EFT in the Pay Method field. Select a Profile Type of Other, and enter VISA in the Name field. Click on OK. To complete your journal entry, debit your Cash In Bank Account, and credit your CC Merchant Receivables Account. This offsets the End Of Period journal entry made for the original booking and sets your CC Merchant Receivables account back to zero. The EFT entry appears on your check register as an EFT Dep. |

EFT Payment Received

There is no need to do a Deposit entry, the Payment Received EFT automatically updates the check register.

Payment Made to a Vendor

To account for a payment made to a vendor for a tour, cruise, etc., enter a Payment Made. This closes the payable created by the sales invoice entered.

1. Click on Payments|Made from main menu.

2. In the Amount field, type in the dollar amount.

3. Change the Payment Date (if it is not the current date) by typing in the proper date.

4. In the Branch field, associate a branch from the drop-down menu to the payment if desired.

5. In the Bank Acct field, type in the appropriate bank account number (1, 2, 3, etc.), or click the arrow to select from the list.

6. In the Remark field, type in free flow information, or leave blank.

7. Click the arrow next to the Payment Method field and choose Check.

8. Type the check number in the Check/CC No field.

9. If this payment is associated with a group, type in the group name in the Payment Group field.

10 To make the payment recurring, type in a Payment Code. (See Payment Codes section in this chapter.)

11. Change the Profile Type to Vendor and Submit to, to Supplier.

11. In the Name field, type in a portion of the vendor’s name.

12. To narrow the list of open invoices, select Vendor Settings and/or Global Settings Tabs. Use any or all of these fields or skip this portion altogether. Click Query to display the open invoice(s).

13. If there is more than one invoice listed, click the first one being closed to highlight it and click Toggle Closed. Repeat for each invoice to close. Click OK to save.

Note: If you add a checkmark to the box next to Agent Adjustment, you will automatically go to a Create Agent Adjustment screen.

Payments Made to Agents

To account for a check written to the agent enter a Payment Made. This payment affects the bank account and updates the General Ledger.

1. Click on Payments|Made.

2. In the Amount field, type in the dollar amount.

3. Change the Payment Date (if it is not the current date) by typing in the proper date.

4. In the Branch field, associate a branch from the drop-down menu to the payment if desired.

5. In the Bank Acct field, type in the appropriate bank account number (1, 2, 3, etc.), or click the arrow to select from the list.

6. In the Remark field, type in a description of the payment. (Client Gift, Overnight Fee, etc.).

7. Click the arrow next to the Payment Method field and choose Check.

8. Type in the check number in the Check/CC no field.

9. To make this payment to be recurring, type in a Payment Code. (See Payment Code section in this chapter.)

10. Enter the Payment Group if applicable. (See Payment Group in this chapter).

11. Change the Profile Type to Agent.

12. In the Name field, type in the name of the agent. Click OK to save.

13. If you would like to show this amount on the agent statement, add a checkmark to Agent Adjustment and create an agent adjustment

14. Trams prompts, "Create a Journal Entry?" (This prompt is determined by how the set up was completed in the Global Defaults Prompt Tab in Utilities.) If maintaining the General Ledger in Trams, click YES.

15. Trams automatically displays a credit to the Cash in Bank account. Choose the appropriate expense account as the offsetting account.

Example Journal Entry

Acct #

Name

Br

Debit

Credit

1000

Cash in Bank

XX.XX

6010

Agent Commissions

XX.XX

16. Click OK to save.

17. If you checked the box next to agent adjustment, you will now have a Create Agent Adjustment screen. In the Amount field, type in the adjustment amount. If the adjustment amount is being added to the amount owed to the Agent, enter a positive (+) amount. If the adjustment amount is being subtracted from the amount owed to the Agent, enter a negative (-) amount.

18. The Adjustment Date is the statement date that the adjustment affects. Type the correct date in this field.

19. Click the Agent Name field and type in the agent name.

20. Click the Remark field, and type a brief description about why the adjustment is being made. (e.g., Overnight Fee, Client Gift, etc.)

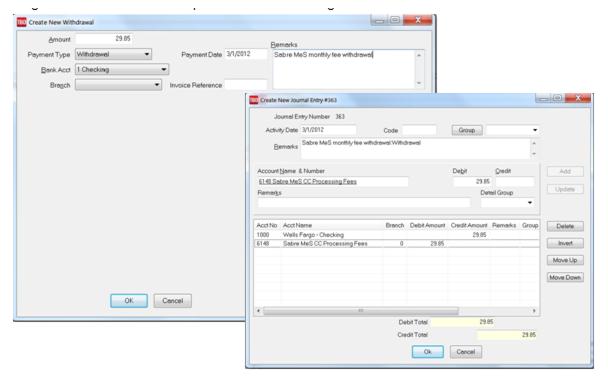

Payments Made for Expenses

To account for a check written for rent, utilities, or any other office expenses, enter a Payment Made. This payment affects the bank account and updates the General Ledger.

1. Click on Payments|Made.

2. In the Amount field, type in the dollar amount.

3. Change the Payment Date (if it is not the current date) by typing in the proper date.

4. In the Branch field, associate a branch from the drop-down menu to the payment if desired.

5. In the Bank Acct field, type in the appropriate bank account number (1, 2, 3, etc.), or click the arrow to select from the list.

6. In the Remark field, type in a description of the payment. (Rent, Utilities, etc.).

7. Click the arrow next to the Payment Method field and choose Check.

8. Type in the check number in the Check/CC no field.

9. To make this payment to be recurring, type in a Payment Code. (See Payment Code section in chapter.)

10. Enter the Payment Group if applicable. (See Payment Group in this chapter).

11. Change the Profile Type to Other.

12. In the Name field, type in the name of the Payee. If there is no match, Trams prompts to build a new profile. (See Other Profiles in the Profiles chapter.) Click OK to save.

13. If this payment affects an agent, add a check mark to Agent Adjustment.

14. Trams prompts, “Create a Journal Entry?” (This prompt is determined by how the set up was completed in the Global Defaults Prompt Tab in Utilities.) If maintaining the General Ledger in Trams, click YES.

15. Trams automatically displays a credit to the Cash in Bank account. Choose the appropriate expense account as the offsetting account.

Example Journal Entry

Acct #

Name

Br

Debit

Credit

1000

Cash in Bank

XX.XX

6150

Office Expense

XX.XX

16. Click OK to save.

17. If you checked the box next to agent adjustment, you will now have a Create Agent Adjustment screen. In the Amount field, type in the adjustment amount. If the adjustment amount is being added to the amount owed to the Agent, enter a positive (+) amount. If the adjustment amount is being subtracted from the amount owed to the Agent, enter a negative (-) amount.

18. The Adjustment Date is the statement date that the adjustment affects. Type the correct date in this field.

19. Click the Agent Name field and type in the Agent Name.

20. Click the Remark field, and type a brief description about why the adjustment is being made. (e.g., Overnight Fee, Client Gift, etc.)

Note: Recurring Expense Payments can be copied from previous payments made from prior months. See Payment Codes section of this chapter to see how to set up and use Payment Codes so as not to have to re-enter payment information. If Payment Codes have not been previously entered, query by a date range by profile name for the previous month’s expense and copy and adjust it as above.

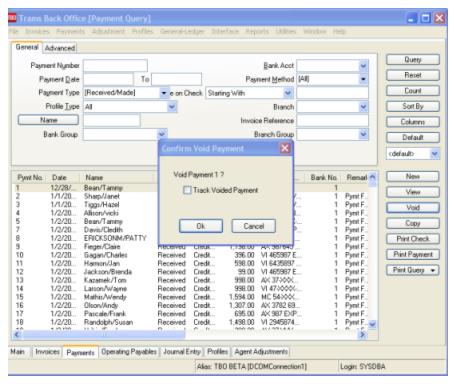

Void or Spoiled Checks

To enter a void or spoiled check:

1. Click Payments Query Screen and click New, and pick Payment Type, Made.

2. Leave the Amount field at zero.

3. Click the arrow to choose the Payment Method of Check.

4. Change the Payment Date to the date the check was voided.

5. In the Bank Acct field, type in the appropriate bank account number (1, 2, 3, etc.), or click the arrow to select from the list.

6. Type the voided check number in the Check/CC No field.

7. Leave the Payment Group field blank.

8. Leave the Payment Code field blank.

9. In the Remark field, type To Account For Voided Check.

10. Change the Profile Type to Other.

11. In the Name field, type any Other Profile Name or create a profile named Void Check. If there is no match, Trams prompts to build a new profile. (See Other Profiles in the profile chapter.) Click OK to save.

12. Trams prompts, “Create a Journal Entry?” Click NO.

13. Now if that payment appears on the query results screen and is highlighted, click on Void and say Yes to Track Voided Payment.

14. If the payment does not appear on the query results, query the payment and click on Void and say Yes to Track Voided Payment.

Bounced Checks

When a check deposited and entered in Trams has bounced, there are three options to account for it.

OPTION ONE

Use this option when the bounced check is in an accounting period already ended and posted.

1. Click Payments|Withdrawal.

2. In the Amount field, type in the amount of the bounced check.

3. In the Withdrawal Date field, type in the date of the banks notice.

4. Change the bank account number to the account number into which the check was originally deposited (1,2, 3, etc.) by typing in the appropriate account number, or click the arrow to select from the list.

5. Leave the Payment Group field blank.

6. Leave the Payment Code field blank.

7. In the Remark field, type any free-flow information. It is recommended to record the name of the client whose check bounced, plus the check number.

8. Click OK to save. Trams prompts, “Create A Journal Entry?” Click YES.

9. Trams displays a credit to Cash in Bank. In the Account Name & Number field, type in the account number for Bounced Checks and debit that account. (Was this account created already? See Adding To the General Ledger Chart of Accounts.) Click on Add to add the entry to the journal entry box. Click OK.

10. When the payment is deposited again (or replaced) enter a Payment/Received with a profile type of Other. In the Name field, type in the client’s name.

11. Click OK to save. Trams prompts, “Create A Journal Entry?” Click YES.

12. Trams shows a debit to Cash in Bank. In the Account Name & Number field, type in the account number for Bounced Checks and credit that account. This clears the balance on the Bounced Checks account.

OPTION TWO

Use this option to keep client statements accurate, and when the bounced check is in an open accounting period.

1. Click Payments|Query|Payment.

2. Query the payment for the check that bounced. Right click on the payment and if "Query Bank Deposit" is not grayed out, select it and 'Void' the Bank Deposit. After voiding the Bank Deposit, close that screen to be back on the Payment that was part of the voided deposit. Click Void. Trams prompts, "Void Payment Number xxx? Yes or No." Click YES to void. This opens up the client balance again and shows it on the Client Balance Report.

3. Enter a payment received with the payment date of the original date of the receipt. Select the Profile Type of Other and Payment Method of EFT. Enter the name of the client in the Name field. Create an Other profile for the client when prompted. Click Yes to create a journal entry. Debit Cash in Bank and credit a 6000 account.

4. Click Payments|Withdrawal and enter a withdrawal for the amount of the bounced check to reduce the bank balance. When prompted, "Create A Journal Entry?" Click Yes. Credit Cash in Bank and debit the 6000 account utilized in Step 3.

5. When the payment is deposited again or replaced, enter a Payment/Received as normal and close the invoice again. Include as part of a new Bank Deposit.

OPTION THREE

(To keep original receipt and deposit in place and show that client still owes money.)

1. Click Payments|Made.

2. Enter the amount of the check. Use the Pay Method of EFT and the Profile Type of Client.

3. Enter the name of the client in the Name field.

4. Create a negative voucher.

5. When the payment is deposited again or replaced, enter a Payment/Received as normal and close the client's voucher. Include as part of a new Bank Deposit.

Payroll Entry

To enter payroll checks and journalize the expense:

1. Click on Payments|Made.

2. In the Amount field, type in the amount of the payroll check.

3. Click the arrow to choose the Payment Method of Check.

4. Change the Payment Date (if it is not the current date) by typing in the proper date.

5. In the Bank Acct field, type in the appropriate bank account number (1, 2, 3, etc.), or click the arrow to select from the list.

6. Type the Check number in the Check/CC No field.

7. Leave the Payment Group field blank.

8. To create a recurring payment, type in a Payment Code. (See Payment Codes section in this chapter.)

9. In the Remark field, type in free flow information, e.g. Payroll Ending 1/31/xx.

10. Change the Profile Type to Other, or Agent.

11. In the Name field, type in the name of the Employee. If there is no match, Trams prompts to build a new profile.

12. Click OK to save. Note: In the Group/Batch field in the Employee’s profile, type in “Payroll.”

13. Trams prompts, “Create a Journal Entry?” If a General Ledger is being maintained in Trams, click YES.

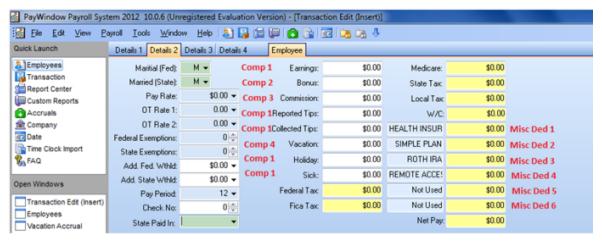

14. Trams automatically displays a credit to the Cash in Bank account. Choose the appropriate expense and liability accounts as the offsetting accounts. Example journal entry:

Amount

G/L Account

Debit

Credit

Net Check

(1XXX) Cash in Bank

411.00

Gross Pay

(6XXX) Salaries Expense*

500.00

Withheld Fed.Tax

(2XXX) Federal Withholding

45.00

Employer FICA

(2XXX) Federal Withholding

24.00

Employee FICA

(2XXX) Federal Withholding

24.00

FICA Expense

(6XXX) Tax Expense

24.00

Withheld State (if applicable)

(2XXX) State Withholding

15.00

Withheld City (if applicable)

(2XXX) City Withholding

5.00

TOTAL

524.00

524.00

Payroll Tax Report and Payment

To show the amount owed for payroll taxes, print these reports:

1. Click Reports|General Ledger|Account History.

2. Type in the G/L Acct No or the G/L Account Name of the tax account. (2000 series account)

3. In the From and To date fields, type in the desired dates.

4. If paying taxes for one of multiple branches, enter the appropriate branch in the Branch field. Otherwise, leave it blank.

5. The Format defaults to Detail.

6. Leave the Pseudo Post box checked.

7. Leave the Active Accts Only box checked.

8. Click Preview to view on the screen. (Or click Print to send the report directly to the printer without viewing first.)

9. The Ending Balance shown is the amount owed.

Note: Repeat these steps for each General Ledger tax account. The accounts match the journal entry accounts of the employees check. (See Payroll Entry section in this chapter.)

To enter the payroll tax payment:

1. Click Payments|Made.